How To Get a Commercial Auto Insurance Quote

So, your business has decided to expand its operations through delivery or other auto-related services? Or maybe you’re just not satisfied with your current insurance policy? Either way, you have determined that it’s time for your business to update or shop for a new commercial auto insurance policy.

While having auto insurance for your business’ vehicles is the best way to protect you, your employees, and your business when out on the road, commercial auto policies can be complex. Due to the numerous factors that can influence your policy, insurance companies will need a lot of information about your business before you can get a quote.

At Berry Insurance, we’ve helped our commercial clients navigate auto policies thousands of times, so we know everything you need to prepare and what factors will most influence your policy.

So, before you apply, let’s review what information is collected and how it can affect your commercial auto insurance quote.

Business operations information:

In order to receive an accurate quote for your commercial auto policy, insurers need to have a full scope of the nature of your business and its operations.

During your application, you will need to provide basic information about your business, such as the name, location, number of operating years, type of industry, and any subsidiaries or affiliated companies to your business.

Depending on what your business will be using its vehicles for, insurers may see your operations as more of a risk. For example, businesses transporting passengers or delivering items may receive higher premiums than company vehicles simply used by employees for transportation. Similarly, what questions you will be asked can vary depending on your industry.

Preparing for an insurance application with information regarding your business’s operations can be the best way to streamline the process, as well as ensuring you receive the most accurate quote.

Vehicle information:

How many vehicles you plan to insure on your policy, as well as the makes, model, and year, will be an important question insurers will ask before issuing a quote.

Whether it’s a single car or entire fleet, your insurance agent or provider will need to collect all information regarding your vehicles when applying for insurance coverage. As each insurance carrier rates every type of vehicle based on their average costs of repair, safety features, claims history, and availability of parts (to name a few) - the cost of the quote you receive can vary significantly.

Insurers will also ask you about what the vehicles will be used for, where they will be garaged, and the estimated annual mileage per vehicle.

Your policy could also be affected if you plan to use a business vehicle that is registered under your personal name rather than the business’ name, making it important to know exactly where your vehicles are registered. For more on if you should buy vehicles in your business’ name, read this article: Buying a Business Vehicle In Your Personal Name vs. Commercial Name.

Driver information:

In addition to information regarding your business’ vehicles, insurers will need to know exactly who will be operating them. If your company has hired drivers, you will need to provide your insurance agent or provider with driver’s names, driver’s license numbers, and dates of birth to add to the policy.

An employee's driving history can play an important role in shaping your auto insurance premium, which is why we advise having driver information handy when looking to apply for a quote.

The drivers you choose for your business has a large effect on your premium, making it crucial for any business owner to choose the right drivers. For more on how the drivers you hire can affect your policy, read this article: How Does Choosing the Right Drivers Affect Your Commercial Auto Policy?

Desired coverages and limits:

In addition to copies of the business' previous coverage history and auto policies (if applicable), your insurance agent or provider will need to know what you hope to get out of your new policy, including the coverages and limits you’re looking for.

While you may be required to carry certain coverages depending on your company's field, how much coverage your business wants to carry can come down to you. This includes what types of coverages you want to add onto your policy and the desired limits and deductibles; limits being the maximum amount the insurance policy will cover a claim and deductible being the portion of the claim you pay out-of-pocket.

At Berry Insurance, we don’t usually offer commercial auto coverage with limits less than $1 million, which is the maximum you can purchase. As commercial auto claims can be expensive, having higher limits ensures your business will be fully covered.

Claims history:

If your company is shopping for a new auto policy, insurers will ask you to provide a copy of your business' “loss runs”, which is a report that shows any insurance claims that your company has filed.

Insurers use this to determine the risk of insuring your business as a client, most insurers wanting to see a minimum of 5 years of claims history from your company's previous auto policy.

The insurance agent you are working with can help you draft a letter to request these reports from your existing insurance agent, but you should know that this step can delay the quoting process significantly if you are unable to get the reports.

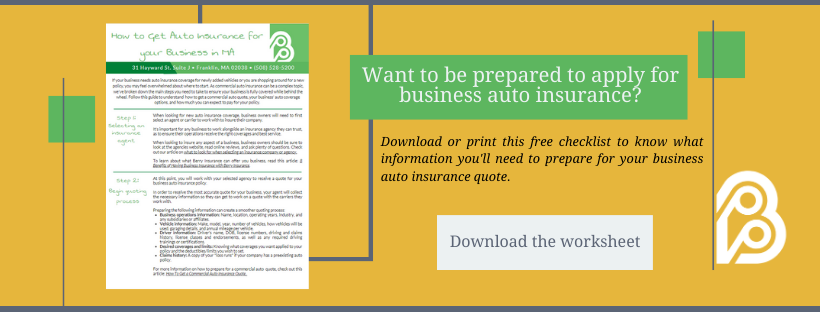

Preparing for commercial auto quotes:

Now that you know just about everything you can expect to be asked when applying for commercial auto insurance, you can prepare for a smooth application process.

If it seems like there is a lot of information that you’ll need to apply for a business auto policy, that is because there are so many factors that go into determining your quote and the right policy for your business.

If you keep these items handy when applying, it can speed up the process, but if not don’t worry. Our agents at Berry Insurance are used to helping business owners regardless, and will ensure your business gets the coverage you need in no time.

Interested in learning what you can expect to pay for your commercial auto policy? Read about what contributes most to the price of your policy here: How Much Does Commercial Auto Insurance Cost in Massachusetts?

If you are instead interested in shopping for a new policy, check out our article on what we recommend as the top commercial auto carriers in Massachusetts.