Lemonade Insurance: An Online Shopping Review

Individuals & Families | Learning Center | Home Insurance | Renters Insurance | online shopping | homeowners insurance | individuals and families | lemonade insurance

Have you ever wondered if you should shop around for your insurance policies? Maybe you haven’t looked at them in a while, and wonder if there’s a better deal available. Or maybe you’ve finally seen enough talking geckos or mayhem on TV that you’ve decided to see what all the fuss is about.

We get it. We love a good bargain too! And catchy jingles and funny mascots entice us just like you.

So, we were curious to see if there really is a better deal out there.

Today we’re going to give you an honest review of shopping for your home and renters insurance online with Lemonade Insurance.

We know what you’re thinking: “Honest? Yeah right.”

But hear us out. We know that shopping online has its advantages. And for some, working with an independent insurance agent just isn’t the right fit. We get it.

But, we also know shopping online isn’t always as simple as it’s made out to be, and some carriers cut corners or neglect to provide clients with a full picture of their coverage, simply to get more sales.

At Berry Insurance, we prioritize honesty and transparency, making sure that our clients always understand the coverage they are purchasing, and why. We don’t undercut coverage, nor will we inflate coverage. No matter which way you choose to shop, we want to make sure you are adequately protected for your unique needs.

Let’s take a full look at Lemonade, taking into account both the sweet and the sour. We’ll make sure you know where to pay attention so you can get the best quote possible.

WHO IS LEMONADE?

Lemonade Insurance Company was founded in 2015 and is based out of New York. They offer renters, condo, and home insurance policies in many states – including Massachusetts, Connecticut, and Rhode Island (for renters and condo only). As of this article’s publication date, they do not offer auto insurance.

The Lemonade business model is to use artificial intelligence in order to quote and issue policies and handle claims. The use of technology to underwrite insurance keeps the company’s costs down, and in turn, they give back some of their profits to various nonprofits. We happen to love this philanthropic commitment.

HOW DO I SHOP FOR INSURANCE WITH LEMONADE?

To shop your insurance with Lemonade, you can download their free app or go to their website. When we shopped, we went online, and found the website to be very pleasant and visually appealing, as well as incredibly simple to navigate.

ADVANTAGES OF SHOPPING WITH LEMONADE

SPEED

Lemonade claims to get you a policy in 90 seconds, and if you are looking for something quick, they can do it.

PERSONALIZATION

We also really loved the personalized A.I. chat bot “Maya.” She came with a picture and a personality, which made us feel like we were actually interacting with someone while we were getting our quote. Plus, they made the process very personable, by including our names in the questions they asked.

SIMPLICITY

Quoting was simple. For both Kaitlyn and Corin’s homeowners and renters insurance quotes, all we needed to give them was our names, addresses, and answer a few quick questions about our properties.

CONVENIENCE

Corin found the company’s use of A.I. and simplicity to be especially convenient. When she first moved to Rhode Island a couple years ago and was applying for renters insurance, she had a longer, more confusing process with another online carrier.

The carrier asked her various difficult questions about her apartment complex and she had to spend several days making calls and digging for the answers she needed to get an insurance policy. In the meantime, this was holding up her process to register her car in her new state because she was bundling her renters and auto policies. Lemonade’s process was far less confusing and provided the instant gratification many are looking for.

After answering the questions, we were instantly given monthly quote options, where we could then get discounts, scroll down to review/change coverages, or finalize our quotes. Super simple.

DISADVANTAGES OF SHOPPING WITH LEMONADE

Yes, shopping with Lemonade is easy. But will you be properly protected with the policy you buy? Here’s where Kaitlyn’s 17 years of insurance experience sends up a few red flags.

Since Kaitlyn and Corin’s quotes both looked at the same categories of coverages, except for the home value, let’s specifically look at Kaitlyn’s quote and discuss what is covered and where you as the consumer need to pay close attention.

INSUFFICIENT COVERAGE AMOUNTS

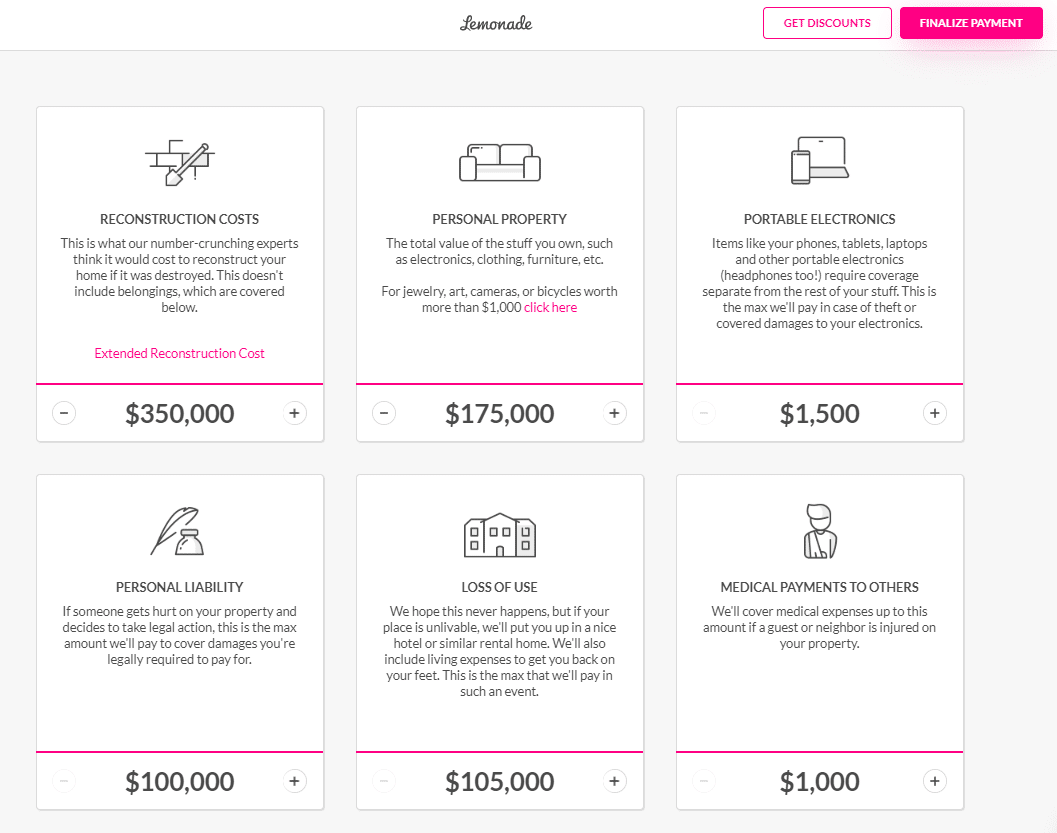

The first part of your quote with Lemonade will give you the basics – those coverages that come standard with every policy. At first glance, they will likely seem good to you. Unfortunately, they may not be good enough. While they are considered “standard” coverages, the limits provided by Lemonade are by no means adequate or sufficient. Let’s review.

-

-

- Reconstruction Cost: Lemonade provided Kaitlyn with a replacement cost value for her home that is 57% of what her current insurance policy offers. To get a comparable quote to her existing coverage, she needed to significantly increase this coverage.

- Personal Property: The Lemonade quote automatically provides 50% of your dwelling value for personal property. Kaitlyn’s current policy gives her 70%. After increasing her dwelling amount, the most she could also increase her personal property was to 66% of the dwelling.

- Portable Electronics: The Lemonade quote has a separate limit of $1,500. This can be increased up to a maximum of $6,000. If you know anything about Kaitlyn, you know she has a house full of rugrats (all boys ranging from 3 year old twins to age 9). So in her house there are 4 laptops, 4 iPads, 2 iPods and 2 smartphones, not to mention 1 smart watch. We’re pretty sure $6K won’t cover it, and her current policy does not have a separate limit for these items.

- Personal Liability: Lemonade Insurance defaults this limit at the minimum of $100,000. For Corin, this seemed like a lot, but for Kaitlyn, she wanted to run for the hills. This is such an incredibly inexpensive coverage that helps protect you against bodily injury and property damage claims and lawsuits.

In today’s world, $100K is nowhere near enough. What if someone slips and falls on your property? What if a child gets hurt on your playground, trampoline, or worse, in your pool. What if your dog bites someone? We’d like to think it will never happen to us, but in our litigious society, it’s easy to imagine how $100,000 won’t get you very far.

In the end, we are shocked that the default isn’t much higher. To increase this coverage to the max of $1,000,000, increased Kaitlyn’s quote by only $21 per year.

- Loss of Use: The Lemonade quote automatically provides 30% of your dwelling value for loss of use. Kaitlyn’s current policy provides an automatic 40%, so there is a 10% reduction in coverage by switching to Lemonade. It’s important to note: there is no magic percentage to use as a guideline, as it really is your best guess at what would be sufficient for you and your family. So while the percentage itself isn’t cause for alarm, we certainly wouldn’t want someone to pay more for less coverage than they already have.

- Medical Payments to Others: The Lemonade quote default was $1,000. Increasing to their maximum of $5,000 raised Kaitlyn’s quote by $10 per year. Consider this: if someone gets injured on your property, you’d most likely want the maximum coverage available to try and avoid out of pocket expenses or a lawsuit.

So far, Lemonade has the basic coverages in place to protect your needs. Unfortunately, the coverage limits they initially present will leave you significantly underinsured. As a consumer, it will be important for you to pay attention to these coverages, and increase as appropriate to protect your family and assets.

LIMITED EXTRA COVERAGES

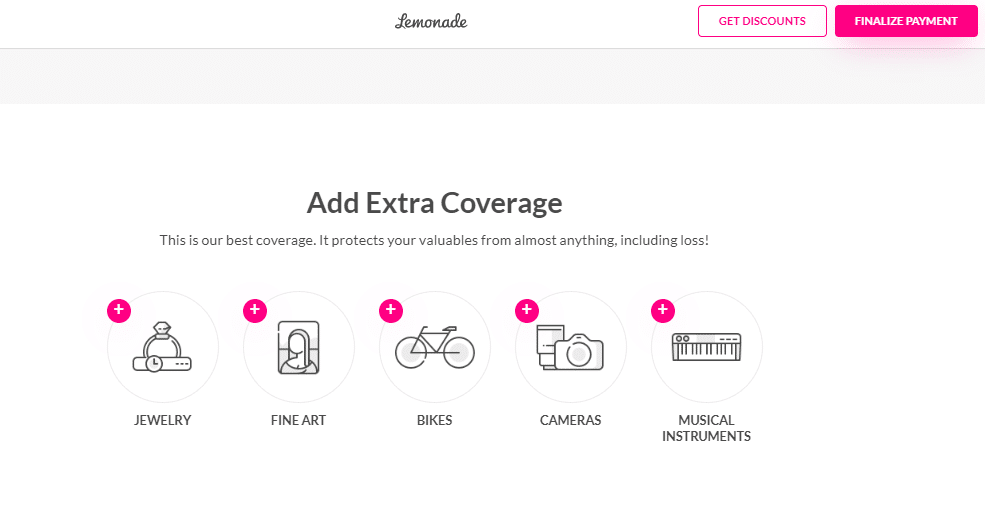

-

- Lemonade offers consumers the ability to separately list or “schedule” certain categories of personal property. The advantage to scheduling items is that if there were a claim, there is no deductible applied, and also, covered losses will now include mysterious disappearance (for example, if you lose your engagement ring down the kitchen sink).

- If you have any of these items, and you choose not to specifically schedule them, the Lemonade policy will limit these items to only $1,000.

- Unfortunately, there was no option to add any other items that may hold sentimental value or have a higher value.

- For example, on Kaitlyn’s current policy, she has her husband’s golf clubs scheduled. Some people may have a large Hummel knick knack collection that is worth money. Or how about family silverware that has been handed down through generations? If it doesn’t fit one of the items above, you can’t specifically schedule it on the Lemonade policy.

-

POLICY OPTIONS LEMONADE OFFERS

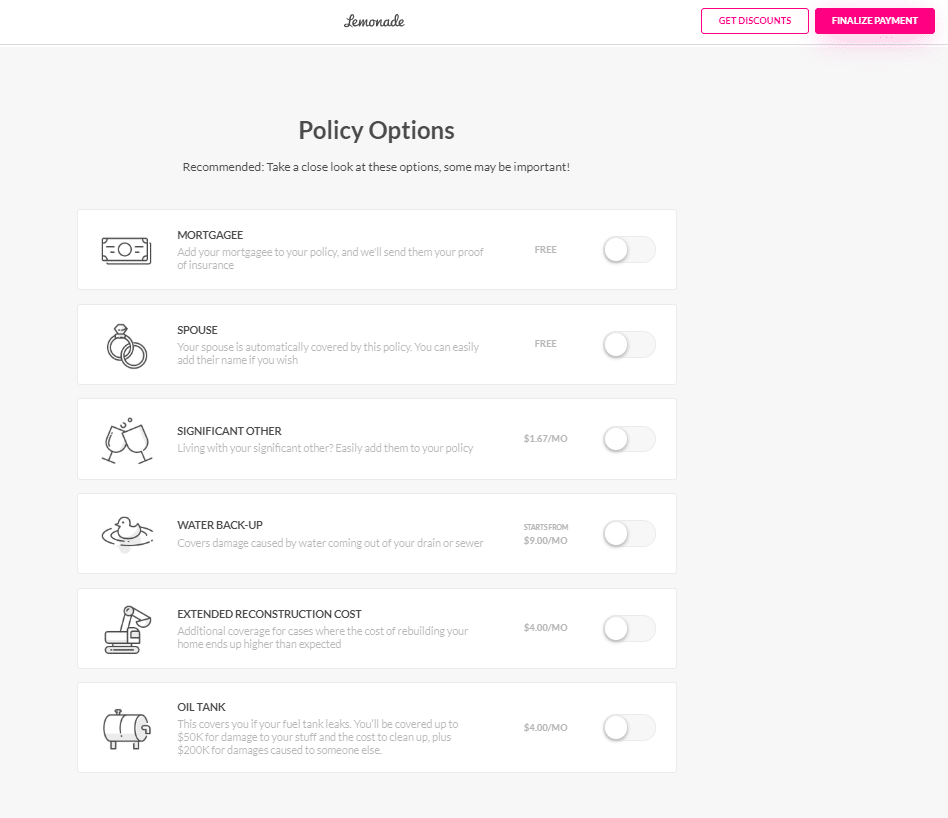

- If you keep scrolling, Lemonade next offers you the ability to add several policy options, some of which are free of charge, and others that incur a cost to you. We found it odd that Lemonade would charge you additional to add coverage for your significant other. Many of the insurance companies we work with will accommodate couples on a policy together at no charge.

- As someone who has experienced two water backup claims herself, Kaitlyn recommends that you consider adding Water Backup coverage, which for her quote, started at $9 additional per month. When she increased this to the max of $10K, it cost an additional $13.50 per month.

She also recommends that you always add the Extended Reconstruction Cost coverage. This allows extra dwelling coverage should building costs rise over your current coverage. To add an additional 25% building coverage, it would have cost her an additional $4 per month. Increasing to 50% resulted in an additional $8 per month.

WHAT’S NOT COVERED

- If you get this far down the page, you’ll also see what’s not covered by the policy – earthquake, high-risk dog breeds, and flood — all normal exclusions.

But what they don’t tell you is that there are a few other things that aren’t covered – such as personal injury coverage, which protects you from claims for libel, slander, or defamation.

We found it ironic that an online insurance company wouldn’t offer you protection for claims that may result from things you say online….and when Kaitlyn inquired through the online chat feature about adding the coverage to her policy, they didn’t seem to know much about the coverage at all and said it wasn’t available for purchase.

If you don’t know what these coverages are, you likely won’t even recognize that they’re missing from your policy. You might think you’re completely covered with your Lemonade policy when in fact, there are some very large gaps.

OVERALL PRICING

A quick and basic quote gave a fantastic price. For Kaitlyn, her initial quote with Lemonade, before any adjustments came out to $132.75 per month, which was a 27% savings over her current policy!

But let’s assume you are one that never takes things at face value, and even when shopping online, want to be sure you have proper protection. How would you know you have that with Lemonade? You could send an email, or use their online chat. But how do you know how qualified they are to answer your questions?

Or, let’s assume you feel confident you can adjust the limits on your Lemonade quote yourself to give you the best coverage for your needs. Is it a fair price? Well, when Kaitlyn amended her quote to get as close to her existing coverage as possible, it increased her premium to $307.42 per month – that’s more than 100% increase over the initial monthly payment. And it’s a 69% increase over what she is currently paying today.

It seems as though Lemonade’s pricing model, like many of its online competitors, is to offer the minimum level of coverage available so as to entice you with their low prices. And it works. We were drinking the lemonade flavored Kool-Aid (so to speak) when we saw the price too.

HOW TO TURN A LEMON INTO SWEET LEMONADE

Let’s not forget….we’re Berry Insurance. A local, independent insurance agent. We know we’re biased, and we obviously feel that shopping insurance with an independent insurance agent is the best way to go. But we admit, shopping online gives you 24/7 convenience, and simplicity and speed that no agent can offer. That being said, while the convenience, ease-of-use and speed can’t be beat, the pricing and more importantly, the protection, just aren’t there with Lemonade.

If you’ve bought online with Lemonade, and would like a no-obligation review of your insurance coverage, please contact us today. We’ll be happy to give you feedback on ways you can save and get better coverage. We promise, no sour lemons here.

.jpg)