What Kinds of Water Damage are Covered in Homeowners Insurance?

Individuals & Families | Learning Center | Home Insurance | Uncategorized | homeowners insurance | individuals and families

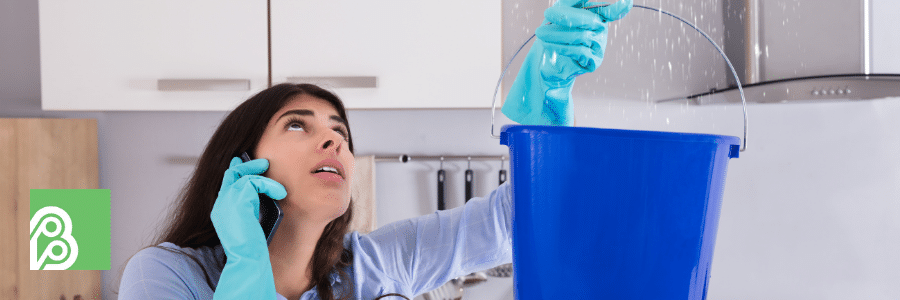

You can’t always prevent water from coming into your home, especially during this time of year.

In fact, as I am writing this, I am watching a wind and rain storm that has been raging for the past seven hours.

Water damage, whether it be wood rot, rusting, mold or bacterial growth, etc., is one of the most common (and most frustrating) causes of homeowners insurance claims. Whether it’s damaged floors, ceilings, walls, or possessions, at Berry Insurance, we have witnessed it many times (in our own homes and those of our clients.)

Water damage can have many causes, but unfortunately, not all of those causes are covered by your home insurance. On top of that, when reading your policy, it may be difficult to determine which types of damage are covered and which aren’t … but that’s what we’re here for.

Let’s go over some water damage scenarios to help you understand what’s covered and what isn’t.

What types of water damage does homeowners insurance cover?

Homeowners insurance generally covers a wide range of water damage situations, if they are considered “sudden and accidental.”

In these water damage scenarios, depending on what exactly is damaged, two types of coverage on your homeowners policy, dwelling and personal property, may apply.

Dwelling coverage pays for damages to the actual structure of your home, while personal property coverage pays for damage to the contents within your home.

However, before coverage kicks in, your homeowner’s insurance deductible you selected when you got your policy will apply. You will also only be paid up to the dwelling and personal property coverage limits on your policy.

Check with your agent or insurance company to see what your specific deductible and limits are.

Sudden or Accidental Discharge

Homeowners insurance covers sudden water discharge, such as from a burst pipe, water heater rupture, or washing machine or dishwasher failure.

Overflow

If water overflows from a clogged toilet or sink (it happens to the best of us) and causes damage, that damage will be covered by homeowners insurance.

Storm-Related Water Damage

Homeowners insurance will also cover any water damage resulting from storms such as rain, hurricanes, tornadoes, and more.

For instance, inclement weather causes a tree to fall on your home, insurance will also cover any water damage, such as mold or wood rot, resulting from the incident.

Damage caused from rain simply seeping into your home or flooding your basement is not covered, but we’ll get into that more below.

Sewer backup or water backup (available at an additional cost)

While not automatically covered in your homeowners insurance policy, water backup coverage can be included for an additional cost.

This insurance will cover you if a pipe, drain, sewer line or sump pumps backs up and causes an overflow in your home.

This is different from the “overflow” coverage listed above because the backup occurs deeper within the plumbing system than the drain.

To learn more about the differences between damages related to water overflow and backup, check out this article: Water Overflow vs. Water Backup: What’s the Difference?

What water damage does homeowners insurance not cover?

While you may think you are fully covered “water damage” coverage does not actually mean all water damage. If the following water damage situations happen to you, they will not be covered under your homeowners insurance policy.

Gradual damage

As we already mentioned, homeowners insurance typically only covers water damage that is sudden and accidental, so gradual water damage, or water damage resulting from poor maintenance usually isn’t covered.

For example, if you have a small drip under your kitchen sink that you ignore for months, the damage it will eventually cause on your cabinets, floors, walls, or ceilings is considered gradual.

Because the leak could have been easily fixed before it caused any damage, insurance companies will not pay for this type of claim.

Some gradual damage scenarios include:

- Water seepage into your home from cracks in the foundation

- Leaks around roofs, windows, and doors

- Leaks in plumbing

Source of water damage

While homeowners insurance will cover damage from a sudden and accidental cause, it will not cover the source of the water damage.

For example, if your dishwasher breaks and leaks, your homeowners insurance will pay for the damaged floor, but will not pay for the broken dishwasher.

Flood damage

Homeowners insurance does not cover damage from floods, which can have a variety of causes including thawing snow, a rain storm, a river or creek overflowing, or even a neighbor’s pool draining into your home.

If you want to be protected from flood damage, you will need to buy a separate flood insurance policy.

Keep your home protected from water damage:

All of these water damage scenarios are plausible and could happen to you, especially during this time of year.

As usual, we expect to see an increase in these situations in the next several spring weeks, so it’s important to know what is covered and what isn’t on your insurance policy.

We can help you by reviewing your policies to ensure you have the proper coverages to help protect yourself from water damage.

And if you ever do need to file a claim related to water damage, you will want to know what to expect to reduce your stress and help the claims process run more seamlessly. To help you prepare, check out this article: Everything You Need to Know About Filing a Home Insurance Claim.

We hope you have a happy (and dry!) spring.

.jpg)